Product

- Product

- Supplier

- Inquiry

- ads

- adssd

- adsajifdoj

2017 Chinese Titanium Dioxide Market Review

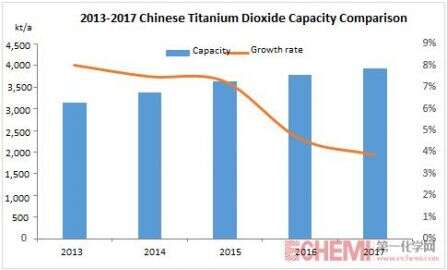

>>Part 1: The Capacity Increased Slightly 2017

The number of newly-added titanium dioxide units was limited in 2017. The increases in capacity were mainly from the expansion. The total capacity of titanium dioxide was 3,938kt/a in 2017, up 146kt/a from last year. The growth rate was 3.85%. In 2017, the approval process for new units needed much time and was complicated on the strict environmental protection requirements.

Moreover, China’s government limits the construction of titanium dioxide units that adopt sulfuric acid method with the capacity being less than 100kt/a. The government encourages the chlorination process and the unit capacity should be over 30kt/a and the content of titanium dioxide should exceed 90%… Read More

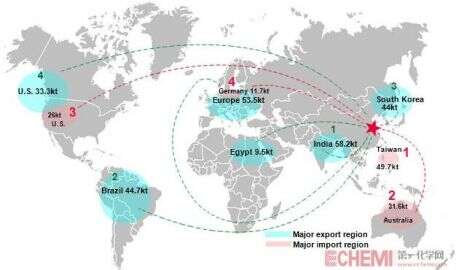

>>Part 2: The Foreign Market Distribution Chart

In 2017, Chinese titanium dioxide producers changed the marketing strategy and some producers started to eye the international market. The first-lass producers exported around 40%-50% goods to the global market. Second-class and third-class producers export 20%-30% goods to teh global market.

According to Echemi’s data, Brazil imported 41.5kt of titanium dioxide in the first nine months of 2017, increasing 30.68% year on year. India imported 58.2kt of titanium dioxide, ranking the first place. France imported 17.8kt of titanium dioxide from China, jumping 184.36% year on year… Read More

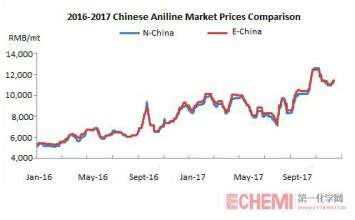

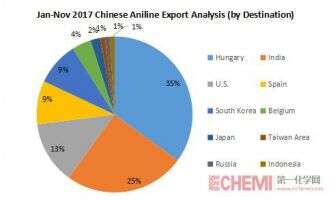

Chinese Aniline Market Saw More Fruits in 2017

Introduction: The Chinese aniline market performed differently and positively than 2016. The average profit hit a new high in recent years. Influenced by the national environmental protection supervision and de-capacity policies, aniline producers released the capacity rationally. Supply and demand had more influences on the aniline market… Read More

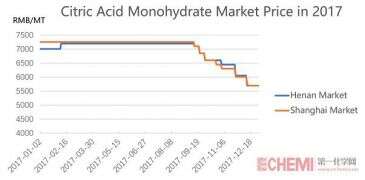

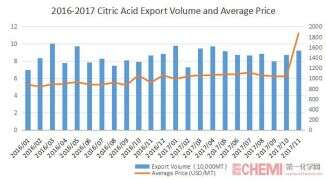

2017 Chinese Citric Acid Market Review: Marching to a High Profit Era

Introduction: In 2017, the citric acid market was prosperous. The price hovered at a high level in the first half of the year, and went down from the 3rd quarter until the end of the year. 2017 was the second year since the corn supply-side structural reform. As the main raw material of citric acid, the price of corn was much lower year on year before October 2017.… Read More

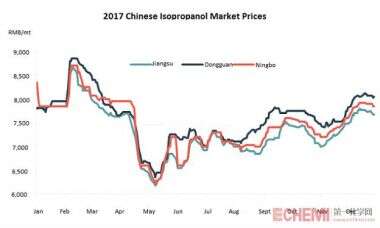

2017 Chinese Isopropanol Market Review

The Chinese isopropanol market fluctuated obviously in 2017.The highest price was RMB 8,700/mt in early 2017. The lowest price was RMB 6,150/mt. In H2 2017, the Chinese isopropanol market moved marginally.

From January to February, the benzene market boosted the acetone prices. Then the isopropanol market moved up on the increasing acetone market. Meanwhile, the propylene market remained high, which supported the isopropanol market.

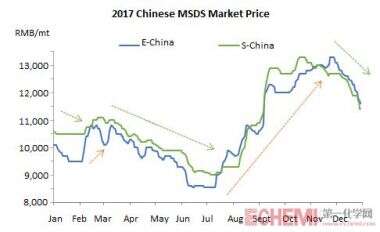

MSDS Market Saw Ups and Downs in 2017

The Chinese ethylene glycol monobutyl ether (MSDS) market fluctuated frequently in 2017. The MSDS market moved down in H1 2017 and rebounded strongly in H2 2017. The lowest price in H1 2017 was RMB 8,550/mt and the highest price in H2 2017 was RMB 13,300/mt, increasing 56%. At the end of 2017, the MSDS market declined by RMB 1,500/mt in December on the increasing supply and tepid demand.

Currently, the MSDS market is still on the downtrend. Considering the weak demand, the Chinese MSDS market will continue to slide in January 2018.

PCDMA

PCMA

ChemicalWeekly

The Coatings Group

Gulfood

FoodTurkey

DKSH

BRENNTAG

Ecommerce Gateway

IPCEXPO.NET

MechChem

Copyright@Echemi.com